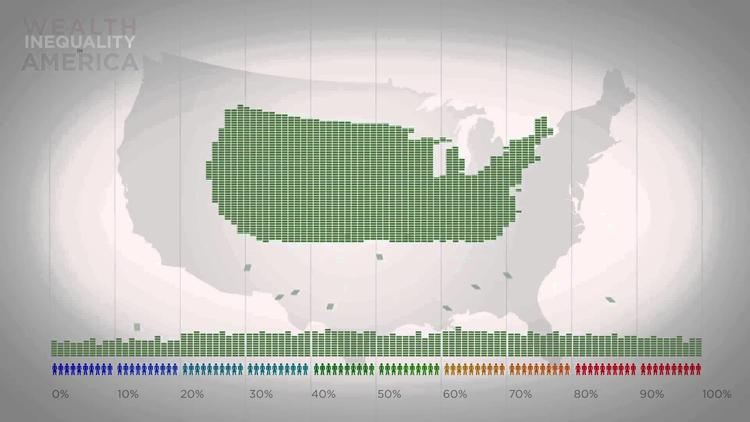

A fascinating video on America’s incredibly skewed wealth distribution, with the top 1% owning 40% and the bottom 40% almost nothing:

and it’s getting worse over time!

A fascinating video on America’s incredibly skewed wealth distribution, with the top 1% owning 40% and the bottom 40% almost nothing:

and it’s getting worse over time!

Juan Cole is the founder and chief editor of Informed Comment. He is Richard P. Mitchell Professor of History at the University of Michigan He is author of, among many other books, Muhammad: Prophet of Peace amid the Clash of Empires and The Rubaiyat of Omar Khayyam. Follow him on Twitter at @jricole or the Informed Comment Facebook Page